Following a tradition, Jesse Bifulco founded the Penbay Estate Planning Law Center to deliver excellence in elder law and estate planning legal services to families.

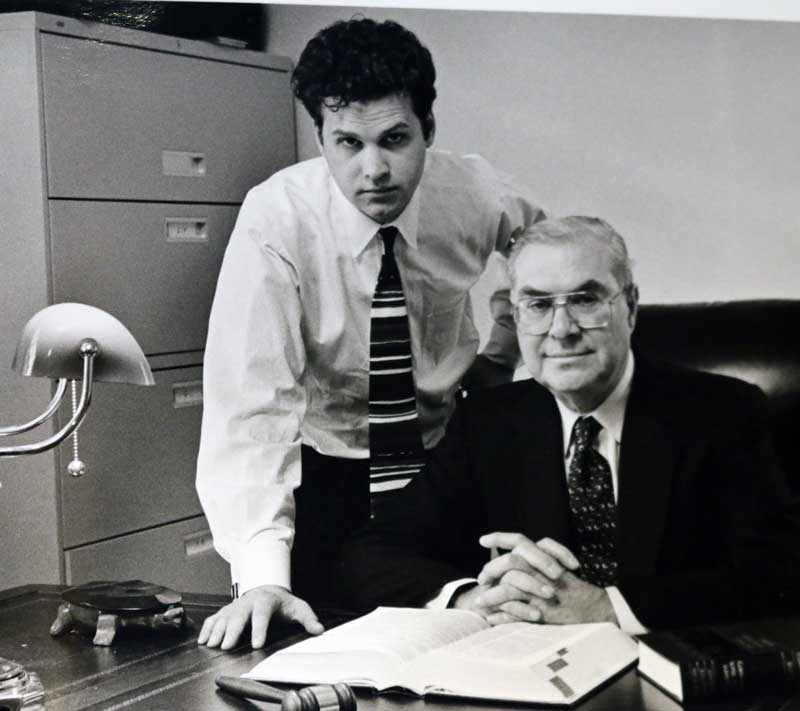

me and Dad back when I had hair!

My father was the lawyer family’s turned to in times of crisis. I learned from him. But the present is more complicated than the past was. My firm focuses on Estate Planning rather than the general practice of law.

As a son, brother of seven siblings, and then husband and father himself, Jesse understands how life events put undue stress on the families he represents. After twenty five years of practice, he has seen how a bad planning or no planning can destroy family wealth and cause family conflict.

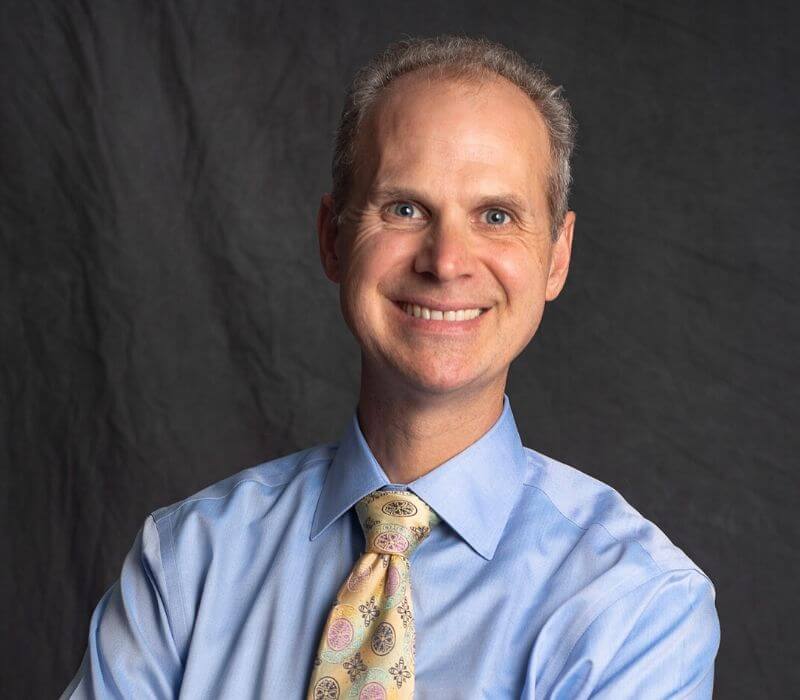

Jesse Bifulco is an elder law attorney and estate planning attorney living in Camden Maine. He’s been helping families as their lawyer for 25 years. He uses wills, trusts and estate planning legal techniques to help his clients make custom estate plans that preserve their family’s wealth, and prevent needless family conflict.

Jesse began practice with his father and mentor Judge Pat Bifulco. Judge Bifulco taught Jesse to be the kind of lawyer people turn to for legal help for their family. Jesse began in New York City, practicing in one of the most intense, active and legally diverse cities in the world. He practiced elder law and estate planning in NYC for ten years before moving to Camden Maine. He represented a diverse array of clients, from every walk of life. He earned the trust of people with both large and modest estates, but who all shared a common goal: to plan and protect for the people they cared about, and to leave a little more than their wisdom for the next generation.

Jesse helps people put their personal legacy of prosperity and caring into a unique estate plan.

I’m passionate about helping people protect their family, prevent loss of property and needless conflicts. I’ve seen what can happen with a bad or no estate plan. I have seen what can go wrong, and I know how to prevent it.

-Jesse F. Bifulco, Esq. Estate Planning Lawyer

Family

Jesse Bifulco grew up in a family with eight kids. He is married to his wife Kristen, and they have three children.

“Estate Planning should be approached from the perspective of how can I protect this family? How can I preserve their property, and prevent family conflict?”

Estate Planning Has Changed Over the Years

In 1995 when I began practicing, many clients could get by with a simple will. But even then, times were changing. The gift tax credit was much lower. We wrote testamentary trusts. Many WWII, and Korea War vets, people in their seventies then were dividing the property between the husband and wife, and creating credit shelter trusts. Perhaps they had a house they bought for $30,000 that was now worth six hundred thousand. With an IRA or a savings account, and then the family camp, or lake house their estate was over the top.

Today there are added complications. If the federal estate and gift credit is different than the state, than many of these old plans will actually cause a state tax.

While many clients do not need tax planning, many do. But the tax we are most concerned about is capital gains. Even if your estate is not subject to estate and gift taxes, your property may still be subject to capital gains income tax. Good estate planning takes into account capital gains and basis issues that could cost your heirs hundreds of thousands of dollars in taxes.

A Simple Will Can Cost You Hundreds of Thousands of Dollars

However, with nursing home costs at $9000 to $14,000 per month they are concerned. If one spouse of a married couple had to go into a nursing home, it could wipe out their savings. Over 70% of people over age 60 will need some long term care before they die.

Estate Planning for High Net Worth Individuals in Maine

As our clients have grown, we have had to grow as well. While many of our clients do not need gift tax planning, many do. Many of our clients are considered high net worth individuals. Estate Planning for high net worth individuals is specialized and complex. In the past, high net worth individuals would have to travel to large metropolitan areas to find a lawyer or firm knowledgeable in this area of law. But now Penbay Estate Planning Law Firm is a law firm in Camden Maine that offers high net worth estate planning services in Midcoast Maine. Many of our clients have low basis property and wish to have a stream of income without incurring confiscatory capital gains taxes. They also have causes and charities they believe in and would like to support. Charitable estate planning is alive and well in Midcoast Maine. There is a way to obtain both objectives.

Your Will or Estate Plan Should Be Reviewed Periodically

Many people come to us to review their estate plans. We have seen some examples of costly mistakes. Whether it is Mainecare asset protection planning or planning for high net worth individuals, a bad plan or no plan will cost you. But the cost is not merely money. Poor planning causes family conflict, and exposes your vulnerable surviving spouse to opportunists and “treasure hunters”.

Estate Planning is Not for the General Practitioner or Online Forms

Many times a simple will can do more harm than good. General practitioners, and online legal services are not estate planning lawyers, as we define it. The estate planning lawyer you choose should concentrate in that area of law. They should earn your trust.

Unlike the generalist, or the online form, an estate planning attorney provides counseling based on your unique family situation, and unique personal goals.

Penbay Estate Planning Law Center, Mainecare Lawyer Camden Maine

Penbay Estate Planning Law Center does Mainecare applications. There are only 3 ways to pay for nursing home costs in Maine: 1. out of pocket, but at $12000 per month, that fund can quickly run out; 2. with long term care insurance, but many don’t have it, or can’t qualify; and 3. Mainecare nursing home coverage. Because this issue is important to our clients, and very complex we spend many hours per year improving and learning techniques to get our clients approved for Mainecare, while at the same time preserving their (assets) money and their property. Every case is different, but the rules are always very complex.

Come and learn how to make a plan for your estate for free

Penbay Estate Planning Law Center teaches estate planning workshops and estate planning seminars. The goal of these estate planning workshops is to give people the information they need to avoid the pitfalls. We can teach you how to protect your house against Medicaid liens and nursing home costs. Our workshops teach families how to leave their vacation home or beach house to the kids for generations to come.

More than just wills and trusts, our clients put their own family into our estate planning documents. We offer estate plans for younger families with minor children, estate planning for the parents of college-aged children, estate and gift tax savings plans for high net worth individuals, and estate plans for business owners with partners.

We will also review your existing will or trust to see if it will achieve your estate planning objectives.