Can I Get Help With My MaineCare Application?

When you are suddenly confronted with a need for nursing home care, most people want to know, can I get help with my MaineCare application? Should I apply for MaineCare? What are my options to protect assets? Read on to learn the answers to these and many more will questions.

You don’t have to face this alone.

MaineCare applications seem simple. But knowing how to get MaineCare and protect assets is NOT so simple.

When You’re Not Sure What to Do…

As elder care attorneys we see this almost every day. People feel traumatized and confused when someone they’re close to suddenly needs nursing home care. Long term care, or even assisted living can be something you just didn’t plan on. While some folks have insurance for this, or have budgeted for it, most people have no idea.

When Should I Apply for MaineCare Nursing Home Benefits?

MaineCare Application Basics

- Am I eligible?

- Can I apply for my spouse/parent?

- Will there be a lien on the house?

What Are the Circumstances When People Need MaineCare?

Here’s what usually happens: someone gets injured. Maybe they have a fall, or a stroke or an accident. Or maybe it’s a slow-motion fall. By that I mean their husband or wife has been taking care of them at home for a long time, but they just cannot do it anymore. Frequently it’s because of Alzheimer’s or dementia. But how ever they arrived there, they have arrived at the point where they must go to a hospital. They are treated. They are discharged for rehab. After the rehab is finished or before its complete, they are told that they need to go into a nursing home, or assisted living facility. Or their spouse says that she or he simply cannot take care of them at home anymore. At least not without help! If your husband or wife, or your parent is discharged from the hospital to a nursing home, what should you do?

MaineCare Application Process

Find out your options BEFORE you apply. Can you get benefits? How much will be lost? What can be protected?

Why Should You Apply for MaineCare?

Call Penbay Estate Planning Law Center TODAY

What is MaineCare?

MaineCare is the state of Maine’s Medicaid program. Medicaid has many programs. One of the programs is MaineCare nursing home coverage. Another MaineCare program is for assisted living. Many people ask me, as an elder law attorney, “how can I get MaineCare nursing home benefits?” or they say, “isn’t MaineCare just for very poor people?” MaineCare is a nursing home or assisted living benefit for people who are not necessarily strictly speaking impoverished. When people ask me “is MaineCare just for poor people”, the answer is, no. In fact, you can own a house worth $893,000 and still qualify for nursing home or assisted living MaineCare benefits.

What Are the Rules for a Mainecare Application for Nursing Home Coverage?

But the rules of MaineCare are very complicated. You should understand that a program like this is very expensive. One of the ways the government controls access to the program is to make rules. There are limits on the amount of assets you can have and still get MaineCare nursing home benefits. So, while it isn’t all about your assets, the rules divide your assets between exempt assets and non-exempt assets. And there is an upper limit to the amount of non-exempt assets you can own and still get MaineCare. There is also something called “spenddown”. There are also calculations made to determine how much of your income should go to pay for the nursing home, verses how much can go to the husband or wife who is still living at home. These calculations are complicated. That’s the bad news. The good news is, you can deduct as an exempt transfer the money you pay your elder care lawyer to complete the application for you. We do these calculations for clients all the time.

On Demand Estate Planning Workshop

Am I Eligible For MaineCare Nursing Home Coverage?

But you may not be eligible for MaineCare nursing home coverage when you need it. Remember, most people do not expect to need nursing home care. Even if it should have been predicted, most people feel totally blindsided by the event that lead to the nursing home. Maybe they should have planned, but most people do not. The problem is, once you need it, you may accidentally mess up your chances of getting MaineCare nursing home coverage by doing your own application. You may also mess up your chances of saving more of your assets by letting the nursing home make an application for you. Why is it important to save your assets? Because you may want your spouse who is still living at home to be able to live comfortably even though you had to go to a nursing home. You may decide that it is fair and reasonable to spend all your money on the cost of a nursing home. Some folks don’t think that is the wrong thing to do. But some would rather preserve something for the people they care about too. After five years the cost is around six hundred sixty thousand dollars. The problem is, many of the things you can do to save some of that money need to be done before you even apply for MaineCare.

Crisis -or- Preplan?

What is the Best Way to Apply for MaineCare Nursing Home Benefits?

The best way to apply for MaineCare nursing home benefits is to find out if you are eligible first. The best way to find out if you are eligible is to ask an elder law attorney. It is not DHHS’s job to make sure you are eligible, or to help you save assets with your MaineCare application. It is not the nursing home’s job to make sure you are eligible, or to help you save assets with the preparation of your MaineCare application.

How Do You Find Out?

So, with some preparation, and good legal advice, you could be eligible in the beginning of the process. This is so even if you never prepared for MaineCare eligibility. The tricky thing about qualifying for MaineCare nursing home benefits is that you need to make sure you are eligible before you apply. If you have applied already, or let the nursing home apply for you, there may still be something you can do to prevent the loss of your assets. There are also things you can do to try and get eligibility after you have been rejected. But it is far better to make sure you’re eligible before ever applying! A MaineCare eligibility plan is a written opinion by an attorney that says when you could qualify for Mainecare and how much of your assets could be protected. You should make sure you are eligible before you ever apply. One of the things I do, as an elder law attorney, is to make a MaineCare eligibility plan for people trying to get nursing home coverage from MaineCare. Many of my clients are concerned about how to protect their assets.

Live Online Estate Planning Workshop!

Gifting strategies that work.

Learn how to protect assets from possible nursing home costs, but also from life circumstances. Is there a way to give away assets and retain control?

How to Apply for MaineCare

The MaineCare application is fairly simple. However, there are many pitfalls that will prevent you from getting MaineCare nursing home benefits if you are not aware of the rules.

You can apply for MaineCare online. However, whether you apply online or with a paper application, the most important thing you can do, is to find out if you are eligible from an elder law attorney first. Let me make this clear: you should find out if you are eligible for MaineCare from an elder law attorney before you apply for MaineCare with DHHS.

What is DHHS?

DHHS or the state of Maine Department of Health and Human Services. DHHS is the state agency given the job of administering Maine’s Medicaid program. Medicaid is a federal government program that provides nursing home benefits for aging disabled people. DHHS has rules that govern its programs. A person over at DHHS will analyze your application for MaineCare benefits. The folks over at DHHS must follow the rules about eligibility.

One of the Mainecare programs is called “Home and Community Benefits for the Elderly and Adults with Disabilities”. In the rules it says this: to get MaineCare nursing home benefits you must “meet the general MaineCare eligibility requirements found in the MaineCare Eligibility Manual (10-144 C.M.R. Ch. 332), medical requirements, and other specific requirements for Home and Community Benefits (HCB) for the Elderly and Adults with Disabilities.” So you need to be eligible, medically eligible and meet other requirements.

The rules go further to say that “Even if a member meets all criteria for eligibility for services under this section, the provision of these services is subject to available funding for this program, individual cost limitations as set forth in this Section and aggregate cost neutrality assurances required by 42 C.F.R. §441.302”

What does all of that mean? It means that the rules are very complicated, as I’ve said before.

Live Online Estate Planning Workshop!

MaineCare Verses Medicare… Does Medicare Cover Nursing Home Costs?

Medicare will only pay for patient care up to a maximum of 100 days. However, Medicare will frequently deny coverage if the care is considered institutional instead of merely rehabilitative. So, you should not rely on getting 100 days of coverage. Sometimes hospitalized patients are discharged to a nursing home before the one hundred days.

Generally, Medicare does not cover nursing home costs. In order for Medicare to pay for nursing home costs, you must have been hospitalized for medically necessary inpatient hospital care at least 3 consecutive days, not counting the date of discharge. That means the care is not what they call custodial. For Medicare to cover the institutionalization these conditions must apply:

- You must be admitted to the nursing home within 30 days of the date of discharge

- You must require skilled nursing or rehab care daily for the condition which caused the hospitalization in the first place and

- The care must be ordered by a physician as needed.

Even if you are covered by Medicare, it will only be for a maximum of one hundred days. And full payment of the cost of care will only be for twenty days. Day 20 to 100 will require a co-payment.

Live Online Estate Planning Workshop!

Register and learn from an estate planning attorney, get your questions answered!

What Is MaineCare?

MaineCare is a joint federal-state program that covers the medical care of certain needy populations in the U.S. Even though MaineCare was established under federal law (as Medicaid), the program is administered by each state on its own. That means that every state has slightly different rules. The cost of the MaineCare program is paid in part by the federal government, and in part by the states. The federal government pays between 50% and 83% of the cost of Medicaid depending on the state.

Does Every Nursing Home Accept MaineCare?

No. Approximately 62% of nursing homes accept residents whose bills will be paid by Medicaid. So it is very important, if you are considering using MaineCare to pay for your nursing home, to know if your nursing home accepts MaineCare. If they do, they cannot evict you just because you start using MaineCare. But if they do not accept any MaineCare patients, they can evict you if you stop paying privately.

Live Online Estate Planning Workshop!

Register and learn from an estate planning attorney, get your questions answered!

How Do I Know If A Nursing Home Accepts MaineCare?

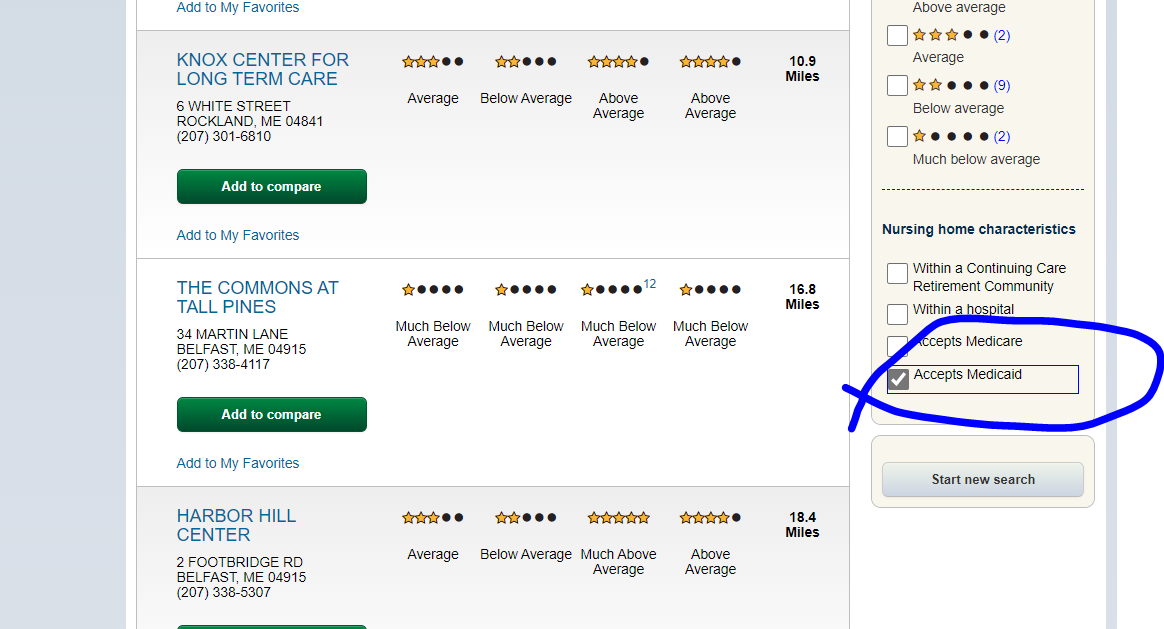

Here is a helpful database of nursing homes that accept MaineCare. You simply enter in your zip code. Then you filter the list by “accepts Medicaid” on the lower right of the screen.

But You Should Find Out First…

The rules to apply are very complicated. If you wish to try and ensure that your application is approved, and try and preserve some of your assets, it is best to find out ahead of time if you qualify. You can find out ahead of time if you qualify for MaineCare by hiring an elder law attorney to analyze your eligibility.

MaineCare Options Plan

If you need to find out if you qualify, or how you can preserve assets, contact us today!

Obtain Your Options Form

and get your plan options within 48 hours of returning the information